How To File Taxes For An Llc With Two Members – TEST new federal law: Most businesses must file a Beneficial Ownership Report to comply with the Corporate Transparency Act. order report

If your business is organized as an LLC, your tax professional may recommend that your business entity be taxed as a sole proprietorship, partnership, or corporation, and you may be responsible for self-employment taxes in addition to federal and state income taxes. tax

How To File Taxes For An Llc With Two Members

Halona is a content marketing strategist who works with the technology industry. He is also a writer/coach for leading global…

How To File Back Taxes

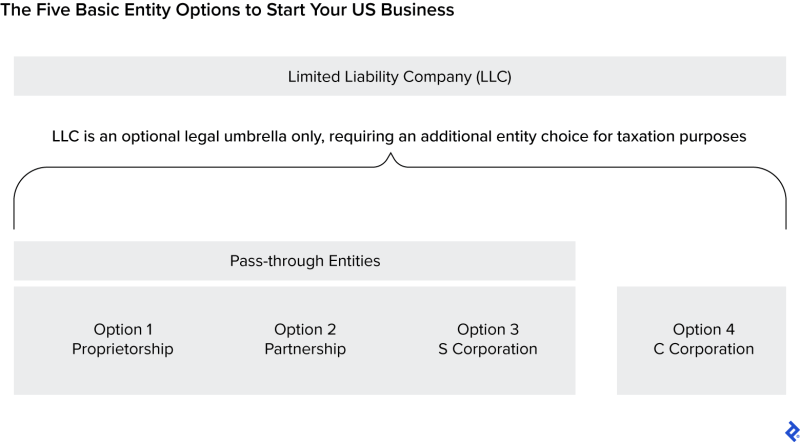

Limited liability company (LLC) owners can choose and change how they file their business taxes with the guidance of a tax professional. This flexibility is one of the qualities that make LLCs attractive to small business owners. But if you’re just getting started, the annual LLC tax filing process can seem confusing.

There are several types of LLCs, and each business structure has its own tax rules. LLCs can file like sole proprietorships, partnerships, or corporations, and it’s important to understand the differences and how they affect how your business pays federal and state income taxes. This article serves to highlight the different tax classifications, their requirements, and best practices for finding the best tax strategy for your business.

LLC tax classification depends on its members, that is, business owners. The IRS determines the standard tax structure based on the number of members. From there, members can choose to change their tax classification. The IRS defines two standard tax designations:

LLCs file taxes under their standard designation. But if you want your LLC to be taxed like a corporation, you can change its tax status by submitting a form to the IRS. It can also re-form as a partnership or proprietorship if the LLC adds or loses members.

I Forgot To File State Taxes. Now What?

Knowing how to file business taxes for an LLC is an important step in keeping your finances on track. If you’re starting out, you may prefer to file as a sole proprietorship or partnership. But as your business grows, you should consult a tax advisor or accountant to see if your LLC can benefit from taxation as a corporation.

Single-member LLC business taxes work just like a sole proprietorship. LLCs report their business income and expenses on Schedule C of the members’ personal individual income tax returns. The member then lists the net profit or loss on the income section of Form 1040, US Individual Income Tax Return.

Because the IRS ignores LLC status for tax purposes, the company files like a sole proprietorship under US tax law. This is what is meant by referring to an LLC as a “disregarded business entity” for tax purposes. Aside from this tax treatment, however, one benefit of a single-member LLC is that they still retain all of their limited liability protection.

If your LLC has more than one member and files as a partnership, the LLC’s income will flow to the members themselves. Members will report this income on their personal or individual income tax returns. Paying multiple-member LLC business taxes involves:

Llcs And The W 9 Form: A Guide To Tax Compliance

LLC members then report their share of profits (or losses) on Schedule E of their personal tax returns. Members must report and pay taxes on all profits, even if they leave some profits in the business instead of taking them home.

Required forms: Schedule K-1 Form 1065, Schedule E Form 1040 Filing date: Form 1065 Schedule K-1 is due March 15. The general delivery date is April 15th.

An LLC can file as a C corp by filing Form 8832, Election of Entity Classification, with the IRS. Corporate taxation is complicated, and it’s a good idea to consult with an accountant before paying business taxes as a corporation. Some reasons an LLC may choose corporate taxation include:

An LLC taxed as a C corp files a corporate income tax return each year. Will file corporate income tax on Form 1120. The shareholders also report all salaries and dividends they receive in their personal tax returns. Owners report their dividends on Form 1040 from their tax returns.

Definition And Steps On How To Form An Llc

It is important to note that C corporations are subject to taxation at both the corporate level and the shareholder level (on personal returns, double taxation must be considered).

A business entity or LLC can also make a subsequent election to file as an S corp (or Subchapter S corporation). An LLC taxed as an S corp (or Subchapter S corporation) follows the same procedures as a partnership:

Like all business structures, LLCs owe more than federal income tax. Additionally, LLCs may have to pay multiple business taxes to the state and federal governments depending on their location and tax classification. The main ones include:

If an LLC files taxes as a sole proprietorship or partnership, the IRS considers its members self-employed for federal tax purposes. When you work for an employer, your employer pays half of your Social Security and Medicare taxes, and you pay the other half. But when you are self-employed, you have to pay the full amount yourself.

Ultimate Guide To Small Business Tax Forms

In your annual tax return, you can deduct half of this tax from your business income, which slightly offsets the impact of self-employment tax. You must include Schedule SE Form 1040 for Self-Employment Taxes with your tax return.

Self-employed individuals must make estimated payments in self-employment and personal income tax every quarter. Failure to file quarterly taxes may result in penalties and interest.

States can set their own tax rates on personal and corporate income when paying estimated taxes. Making accurate payments on state taxes is just as important as federal filings. LLCs and their members may need to file income and franchise taxes in each state where they do business. State tax forms and due dates vary from state to state.

This state income tax is in addition to your LLC’s annual renewal fee. Similar to business income tax, each country determines a unique fee. The due date also varies according to the situation. Consult your registered agent or business advisor for information on renewal fees and due dates.

What Is An Llc? Limited Liability Company Structure And Benefits Defined

In addition to your LLC’s annual renewal fee, it’s important to note that state income taxes may also apply. This state income tax is separate from the annual renewal fee and is specific to each state. Dates for state income tax may vary depending on the state. For more information on specific dates for your country, we recommend consulting a registered agent or trusted tax advisor.

LLCs can change their tax classification by adjusting their ownership structure or choosing to file as a corporation. LLCs can change their tax status at any time. However, they cannot elect to change their status again until 60 months after the effective date of the first election.

Many LLCs change their classification to corporations. But in rare cases, they can switch from partnerships to proprietorships or vice versa. Carefully consider the advantages and disadvantages of each structure before making a decision.

Once members decide on a change in LLC structure, they must file with the IRS. If the LLC does not file the appropriate forms on time, it may have to pay taxes based on its default classification. The form you submit to change your classification depends on your new structure:

Ways To File Taxes For An Llc

LLC filing, with or without a trained tax professional, requires skill and patience. To see the best tax results for your business, be sure to follow the best practices below.

Each LLC tax classification must file a unique form on a different tax date. Learn the IRS guidelines on estimating tax payments in advance to avoid incorrect fillings or missed deadlines during tax season. This proactive approach will also highlight tax breaks, tax benefits, and tax loopholes that can benefit you.

A multiple-member LLC must file a separate Form 1065, and an S corp LLC must file a Form 1120-S.

The IRS offers a special deduction to LLCs during the first few years of operation. You have a better chance of seeing your business grow by taking advantage of these opportunities.

How To File Taxes As A Cpr Instructor Or Cpr Business

If you have a multiple-member LLC, or if your LLC chooses to file taxes as an S corp or C corp, then the LLC must file a separate tax return from your personal tax return.

Not sure what legal structure best suits your business needs? Are you having trouble distinguishing whether your LLC is a single-member LLC or a multi-member LLC? It is best to do further research with an experienced tax advisor to get the best tax benefits.

Whether you need legal advice, information on corporate tax returns, or tax expertise from a tax professional, we can help get your LLC off the ground.

This article is for informational purposes. This content is not legal advice, it is the expression of the author and has not been evaluated for accuracy or changes in the law.

New Jersey Llc: How To Start An Llc In New Jersey In 12 Steps

By knowing what other trademarks are out there, you will understand if there is room for the mark that you want to protect. It is better to find out early, so you can find signs that will be easy to protect.

Writing a will is one of the most important things you can do

How to file quarterly taxes for llc, how does an llc file taxes, file taxes for llc with no income, file taxes for my llc, how to file business taxes for llc, how to file taxes for llc partnership, what form to file for llc taxes, how to file taxes with an llc, how to file taxes for an llc, file taxes for llc, how to file taxes for llc with no income, how to file your llc taxes