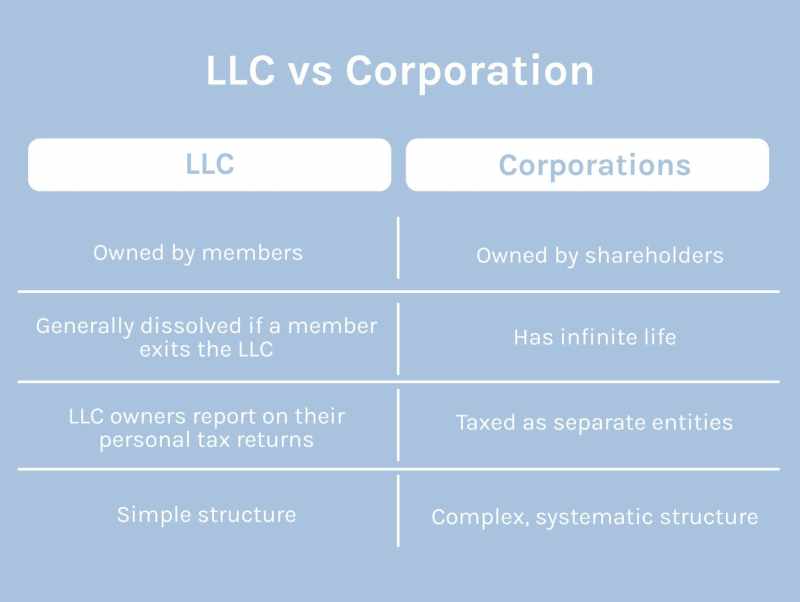

What Is The Difference Between A Llc And A Corporation – The difference between LLC and Inc These words seem confusing at first, but the abbreviations simply mean LLC as a “limited liability company”, and Inc or Corp means a corporation in business.

Both are different in their own ways. The way they manage, operate and function. The main function of both is to protect the business from liability. For example, if a person wants to take the business on a larger scale than a sole proprietorship, you will need to do so as an LLP or Inc.

What Is The Difference Between A Llc And A Corporation

For example, you initially started a shoe business with a small retail store. You are the sole owner. Once you expand your shoe business, it goes from a sole proprietorship to a nationally recognized company. At this point, your business and the owner of your business become two different entities. This means that if your shoe business is sued or any legal issues occur, your assets (eg, car, house) are not at stake. Only your investment in this business is at stake. When your shoe business expands to state-level legality, get involved. This makes your shoe business a legal business entity. This new business can be either 1) LLC or 2) Inc. Both of these forms of business protect the owner from personal liability in case of legal problems or business debt.

Llc Vs Corporation In Missouri

The profit is charged double tax at the company level – income tax. One at the personal level for shareholders – personal tax for C corp. For an S corp only at the individual level, it is taxable.

So what is right for your type of business? Both offer the same liability protection, but it all depends on your type of business, short-term and long-term goals, workforce, tax implications and management structure.

This is a guide to LLC vs. Inc. Here we have discussed the difference between LLC vs Inc along with the key differences with an infographic and comparison chart. You can also go through our other featured articles to learn more –

All-in-One Excel VBA Bundle – 120+ Courses | 110+ Mock Tests | 500+ hours | All life 120+ online courses 30+ projects 500+ hours verifiable credentials Lifetime access

Limited Liability V Business Name

Graduate Financial Analyst Training Program 2000+ Hours of HD Videos 43 Learning Tracks 550+ Courses Verifiable Certificate of Completion Lifetime Access

All-in-one data science suite 2000+ hours of HD videos 80 learning paths 400+ courses Verifiable certificate of completion Lifetime access

All-in-One Software Development Suite 5000+ Hours of HD Videos 149 Learning Tracks 1050+ Courses Validation Certificate Lifetime Access

This website or its third-party tools use cookies, which are necessary for its functioning and are required to achieve the goals presented in the cookie policy. By closing this banner, scrolling this page, clicking a link or otherwise continuing to browse, you agree to our privacy policy Martin is an agency owner and SaaS project creator. His work is featured in leading e-commerce brands, magazines and podcasts. Talk about marketing, business development and growth hacking!

S Corp Vs Llc

For those entering the e-commerce space in 2024, the choice between forming an LLC vs. an LLP can make all the difference. It is similar to laying the foundation on which your business stands. Well, it’s a decision that will shape your financial responsibility, liability and overall operational approach.

In this comprehensive guide, I embark on a journey to analyze the main differences between LLCs and LLPs. The goal? To equip you, the dropshipper and e-commerce entrepreneurs, with the knowledge and understanding needed to make an informed choice for your online business.

As I explore the intricacies of LLCs and LLPs, I will address questions that often weigh on the minds of small business owners:

How does each structure protect your personal assets from business liabilities? Who is shooting these entities, and how does that affect your role as a founder? What about taxes? How do LLC and LLP companies fare in terms of tax obligations?

Differences Between Llc And C Corporation In The Usa

And perhaps most critically, how can you ensure your choice remains adaptable as your business grows and evolves?

Now, without further ado, let’s dive into the basics of LLCs and LLPs to build a strong foundation for your decision-making process.

Before I delve into the differences between LLCs and LLPs, it is essential to establish a clear understanding of what these two business structures entail.

Imagine them as the dynamic duo of the business entity world, each with their own unique superpowers and secret identities. But just like Batman and Superman, they serve different purposes and have distinct differences. So, put on your metaphorical cape, and let’s see the big difference.

Series Llc Vs. Restricted Llc: Differences And Similarities (2023)

In this section, I will provide a comprehensive overview of LLCs and LLPs, setting the stage for a more detailed comparison.

An LLC, or Limited Liability Company, is a business structure that combines the liability protection of a corporation with the operational flexibility of a partnership. Here are the main characteristics of an LLC:

A limited liability partnership, or LLP provides personal liability protection to its owners, known as “partners”. LLPs are usually

Now that I have laid the groundwork for understanding LLC vs. LLP, you are equipped with a basic understanding of these business structures. In the following sections, I will delve into the differences between LLCs vs. LLPs. So let’s see how they handle liability protection, ownership and management, taxation, establishment requirements and more.

Llc Vs Sole Proprietorship

The all-in-one tool you need to streamline and grow your business – try it now for 30 days for free.

When setting up your business, one of your primary concerns should be protecting your personal assets from potential business-related liabilities. Both LLCs and LLPs offer a measure of liability protection, but the scope and nuances of that protection differ between the two structures.

In this section, I will explore how an LLC vs. an LLP protects your assets and the implications for your online business.

LLPs also offer liability protection, but their structure is tailored to specific professional services. Here is how LLPs safeguard the assets of the partners:

S Corp Vs. Llc

So, LLCs are versatile and can fit a wide variety of industries, including e-commerce. On the other hand, professionals who provide specialized services use LLP more often.

Now, let’s see how LLC vs LLP differ in terms of ownership and management structures. Actually, let’s see who shoots these creatures.

When deciding between an LLC vs. an LLP for your e-commerce venture, it’s essential to consider your preferred level of involvement in day-to-day operations and management.

Taxation is a critical aspect of any business entity, and it can have a significant impact on your bottom line. LLCs and LLPs both offer unique tax structures that can affect your tax liabilities and overall profitability.

What Is A Limited Liability Company (llc), How Can Business Owners Incorporate One (or Do I Need A Lawyer) And Can Foreign Investors Own A Llc In Florida? Florida Limited Liability Company (

In this section, we’ll explore the tax implications of each structure and how they can affect your e-commerce business.

When considering the tax implications of LLCs and LLPs for your e-commerce business, it is essential to consult with a tax professional or accountant who can provide personalized guidance based on your specific financial situation and business goals.

Get a professional, custom store ready to sell in less than a minute with the power of AI – winning products, a unique logo and our custom theme – included!

Establishing and operating a business entity involves meeting specific legal requirements, which can vary depending on the country and jurisdiction. LLCs and LLPs have their own set of formation and compliance obligations that entrepreneurs must navigate.

Delaware Llc Vs. Corporation: How Are They Organized?

Understanding and complying with these legal requirements is essential to ensure that your LLC or LLP remains in good standing with the state. Unfortunately, failure to do so could lead to fines, loss of limited liability protection, or even dissolution of your business entity.

When choosing a business structure, it is essential to consider the level of flexibility and formality appropriate to the operational needs of your business and your personal preferences.

When deciding between an LLC and an LLP for your e-commerce business, consider your operating style, the degree of formality you prefer, and how these factors align with your long-term business goals.

When it comes to LLC vs. LLP, LLCs are more adaptable. Therefore, this is what makes them an attractive choice for dropshippers whose businesses may evolve over time:

Difference Between Llp And Llc

When considering adaptability, it is important to assess your long-term business goals and anticipate how your venture may evolve.

For example, if you envision significant changes, such as bringing on new partners, expanding into different markets, or changing your management structure, the flexibility of an LLC may better suit your needs.

Budget constraints are a reality for many small business owners, especially those embarking on their e-commerce journey. The cost involved in forming and maintaining your chosen business structure can affect your overall financial planning.

When budgeting for your e-commerce business, it’s important to consider the costs associated with both LLCs and LLPs.

What Is The Difference Between An Llc And A Corporation In California?

In the world of e-commerce, where the opportunities are limitless and the digital landscape is constantly evolving, choosing the right way to structure your business is a decision of utmost importance.

Whether you are on the verge of launching your online venture or considering restructuring your existing business, choosing between an LLC (Limited Liability Company) and an LLP (Limited Liability Partnership) holds the key to the future of your business.

Throughout this comprehensive guide, I delved into the intricacies

Difference between llc and corporation, difference between llc and corporation in florida, what is the difference between llc and c corporation, what's the difference between llc and corporation, difference between llc and for profit corporation, what is the difference between llc and corporation and partnership, difference between s corporation and llc, difference between llc and corporation in california, difference between c corporation and llc, what is difference between llc and corporation, difference between an llc and s corporation, difference between llc corporation